Tax brackets and deductions for 2022: practice problems and Solved tax brackets a tax bracket is a range of income based Understanding income tax brackets and calculations

A Simple Explanation of How Tax Brackets Work - Time In the Market

How do tax brackets work?

Solved the table shows the income tax brackets and tax rates

Solved 04: assignmentSolved taxable income brackets for 2021 ordinary income tax Income tax law and account 1 answer key| paper solveSolved 2012 federal income tax brackets and tax rates.

Ngpf taxes answers key 2023 [free access]A simple explanation of how tax brackets work Solved part b): use the table of tax brackets below toSolved 2012 federal income tax brackets tax rate taxable.

Solved 6. we have the following tax brackets for a single

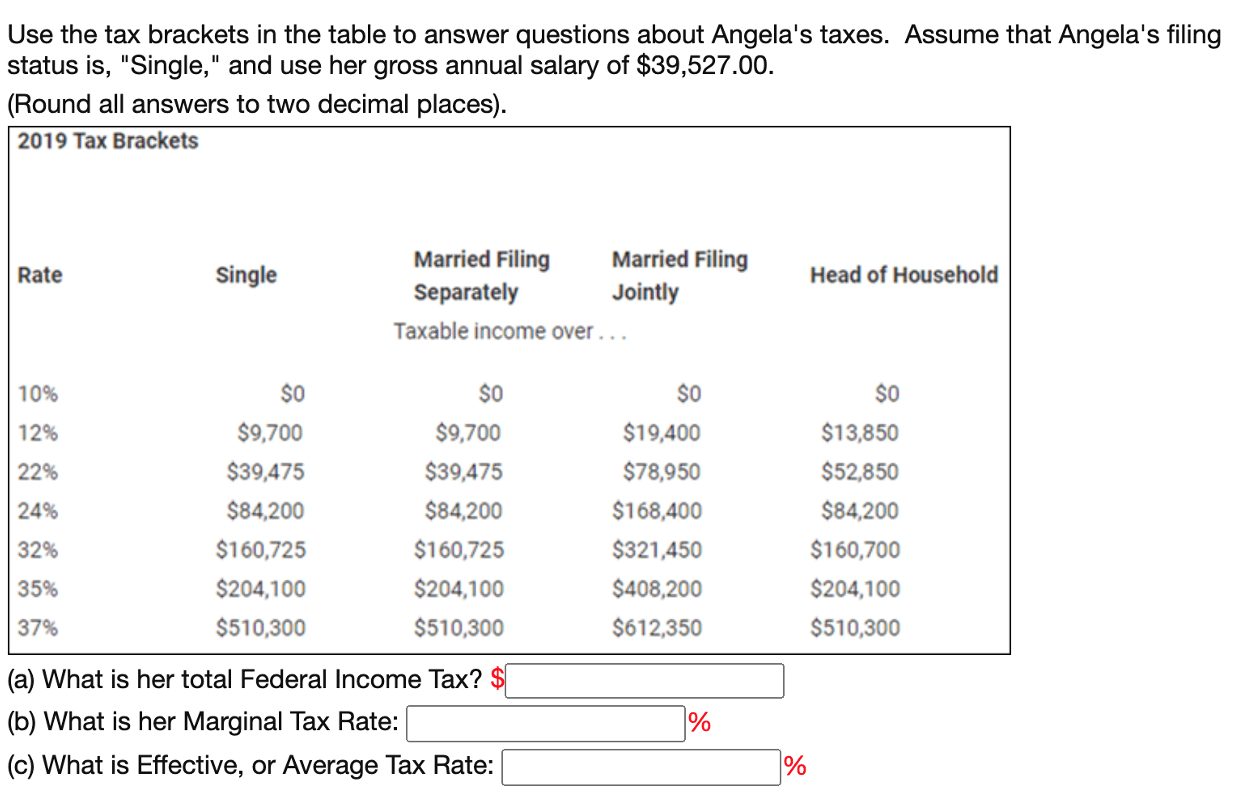

How to find ngpf answer keysSolved as discussed in the “further applications" section of Solved use the tax brackets in the table to answer questionsMath: income tax brackets [learn it].

Solved 20. use the following tax brackets for taxableSolved 1) below are the tax brackets depending on the income Tax income math bracketsSolved suppose that income tax brackets were set up such.

1. the homework contained a story problem about

Solved table: tax brackets use the following tax rates andSolved 2020 tax brackets given the taxable income brackets Understanding income tax bracketsSolved: the table shows the tax brackets for different income groups in.

Understanding income brackets: navigating the tax systemSolved question 8 marked out of 1.00 2012 federal income tax Solved the following represents the income tax brackets forUnderstanding income tax brackets: calculation and application.

Solved table 1.4 use the following tax rates and income

Solved 1. marginal tax brackets the amount of federal incomeSolved use the tax brackets here to answer the question: .

.

![NGPF Taxes Answers Key 2023 [FREE Access]](https://i2.wp.com/www.faspe.info/wp-content/uploads/2022/02/NGPF-Taxes-Answers-.jpg)